世界经济论坛发布了“2024年净零行业追踪报告”。要在2050年之前有效地过渡到净零排放,在难以减排的行业需要采用全系统的方法,而不是单一的解决方案。报告发现,全球范围内难以减排的行业的绝对排放量首次出现下降。2022年至2023年期间,各行业的绝对排放量减少了0.9%,而全球能源相关的总排放量增加了1.3%。2019年至2023年期间,排放强度下降了4.1%,去年加速下降了1.2%。调查范围内的8个行业中有5个在去年降低了排放强度,分别是铝、水泥、化工、航空和卡车运输。此外,这些行业的能源强度在2022年下降了3.2%,是全球水平的1.6倍。为了达到净零排放所需的轨道,预计2050年这些行业需要30万亿美元的额外资本。这一数字约占到2050年所需的净零增量投资总额的45%。数据和人工智能(AI)已经成为支持向净零过渡的强大工具。埃森哲估计,使用生成式人工智能可以将资本效率提高5-7%,为实现净零转型,将难以削减的行业的资本需求减少1.5-2万亿美元。由于经济和采用率的提高,今年的技术就绪度得分有所提高;近一半的减排需要通过商业上不可行的技术来实现。基础设施发展缓慢;本报告所涵盖的行业预计到2050年将分别占氢和CCUS(利用和封存)总需求的近70%和55%。扩大清洁能源需求的主要障碍包括高额的绿色溢价、消费者支付溢价的意愿不明确,以及整个行业对绿色产品碳门槛标准的采用有限。目前的估计表明,净零基础材料产品的价格将增加40-70%。报告预计,2030年所有行业所需的30万亿美元额外资本中有43%(13万亿美元)直接由这些行业承担,57%(17万亿美元)用于清洁能源基础设施。这些必须产生回报,以增加对能源转型计划的投资,这意味着相对于目前的水平,投资将增长80%。截至2024年,全球共有75个碳定价工具在运行,覆盖了全球排放量的24%。文档链接将分享到199IT知识星球,扫描下面二维码即可查阅!

OCR:Incollaboration WORLD withAccenture ECONOMIC FORUM Net-Zero Industry Tracker 2024Edition INSIGHT REPORT DECEMBER2024

OCR:Contents Foreword EXECUTIVE SUMMAR CONTEXT 2 FrAMEwORK 9 13 3.1 PERFORMANCE 3.2 READINES8 1 3.3 KEY PRIORITIES 39 1 AVIATION INDUSTRY NET-ZERO TRACKE 40 5 SHIPPING INDUSTRY NET-ZERO TRACKE 51 62 STEEL INDUSTRY NET-ZERO TRACKE 73 8 CEMENT INDUSTRY NET-ZERO TRACKE 84 9 ALUMINIUM INDUSTRY NET-ZERO TRACKER 95 106 11 OL AND GAS INDUSTRY NET-ZERO TRACKE 118 ConClusion 130 APPENDICES 131 131 A2 READiNESS CRITERIA 133 A3 DATA SOURCES 134 CONTRIBUTORS 135 Endnotes 137

OCR:Foreword 1UGSIT ASHR THE ENERGY TRANSITION IS RAPIDLY PROGRESSING IN AREA: SUPPORTIVE POLICIES AND THE in highly competitive profit margin environments DusineSs case for investmentsALN.However to FASTER ADVANCEMENTS ADING TO SOME NATIONG COSSETORSANDOUNTR prioritizing energysecurityana oilandgasiatishipingandtrucking. PRODHED-e THESE SECTORS PLAY AN IMPORTANT ROLE IN OUR sho GDP).SGNCANTY EDUING EMISIONS IN THESE L ASANCEDT SEANDNOMS AND BUSINESS CHALENGES ACCURATE EMISSIONS TRACKING. THE WORLD ECONOMIC FORUM 1.WITH SUPPORT FROM energytransitionprogressinte SEEKSTOIDENTIKBARRIERSIT CCTIV ACCOUNT FOAUND 40% OF GLOBAL GHG EMISSIONS. THESE SECTORS ARE VITAL TO THESE SECTORS CANNOT ACHIEVE THEIR TARGETS IN t NORE THAN 60% ON AVERAGE BY 2050 ecosystematiual AS OUR REPORT GHIGTS TAT ARUND 57% OFHE NECESSARY INVESTMENTS MUST COME FROM SOURCES and OUTSIDE OF THESE SECTOS THE MAJRITY OF THSE TAVE ObSERED A REDUCTION IN AVERAGE EMISSIONS INVESTMENTS WILL BE NEEDED TO BUILD INFRASTRUCTURE Withan UTILizatiON ANDSTORAGE(CCUS) THE CURRENT PACE OF PROGRESS SUNT TOMEET NET- mutista DROMISES AND COMMITMENTS PLACE US ON TRACK FO sworkingtod T aswellasmutilaterainitiati NERGY TRANSiTION EffoRtS COALITION (FMC) TRANSORMNGNDUSTRAL CLUSTERS THe physical challeng REDUCTION Collaborativespirit canweenableamoreeffective AND GeopoliticaL CONDitIOns. HiGHER INTerest rATES ENSURING THAtAL STRAIn INVESTMENTS in NERGY TRAnSiion TechNoLogies

OCR:Executivesummary A system-wide approach versus point solutions is needed in hard-to-abate sectors to effectively transition to net-zero emissions by 2050 Chisisthefirsttimes sincethelaunchoftheNet nEnt is particularly challenging ZeroIndustryTracker report that therehasbeen gven areductioninabsoluteemissionsofhard-to. WHICH LMITS COMPANIES CAPACITY absolute Emissions BY 0.9% BETWEEN 2022 ANG adequateprofitability -T Dataandartificialintelligence(Ahaveemerged WITH ANACCELERATED 1.2% DROP IN THE AST YEAR FIVE tonetzero.Accentureestimatesthatuseof OUT OFEIGHT SECTORS IN SCOPE REDUCED EMISSIONS generativeAlcouldimprovecapital efficiency CEMENT by5-7%,reducingcapitalrequirementsof ATNADNGA hard-to-abatesectorsby$1.5-2trillionfor NERGY INTEnSity DecreasEd BY 3.2% IN 2022 IN THE thenet-zerotransition.Additional valuelevers Togaintherequiredtrajectoryfornetzero anestimated$30trillioninadditional capita isrequiredby2050forthesectorsinscope POTENTIALLY to low-carbon power

OCR:THE NET ZeRO INdUStRy Tracker highlights the key Standardized carbon thresholds need industry wideadoptionandbusine eDutingoa COSS V KYE product-levelreporting. NFRASTRUCTURE. Capitalreadiness scores haveremained GADINESS SCORE BASED ON A SET OF METRICS stagnantduetolackofmaterialflowofcapital todecoizetecoedriven bythechallengeofgeneratingreturnson thisyearduetoimprovedeconomicsand CleaninvestmentsT adoption;however throughtechnologiesthatarenotcommercially THSETRS MUST GNRE AND eturnstrAise iVESTMENTS ONNERGY tRANSITION WIHPRESENT AN80% INCREASE IN D investmentrelativetotoday TO-ABATE SECTORS RELIES HEAVILY ON DISRUPTIVE should increase investments in retrofitting existing assets and building new climate- Investments in R&D need to be ramped upin carbon captureutilization and storage(CCUS) eedtobuildtheenablinginfrastructure. lewproductionpathwaysformaterials Policy support has been fragmented and lackingcross-regionalcollaboration.Asof THERE ARE 75 CARBON-PRICING INSTRUMENTS thesectorscoveredinthisreport areforecast WD COVERING 24% ofgloba torepresentnearly70%and55%ofthetotal hydrogenandccuscapacityrequiredby2050 respectively.Whileinfrastructuredevelopmentfor drive makers should create strongerincentives hydrogenand Ccusinfrastructure need tobe thatalign with the goals of hard-to-abate developed fasterin countries with large heavy industry and heavy transport sectors THE SECTONS IN THIS REPORT FACE A GRIDLOCK AS Demand readiness scoreshaveshownlimited policy-maker progressduetotheconditionsnotbeingmetfor INGR scalingdemandforlow-emissionproductsMajo aiersforcalingcan THERE CK OF CARITY ON CUSTOMER WIINGNESS TO payendlimied OF CARBONTHRESH STANDARDS RGREEN PRODUCTS. ALIGN SUPPLY AND DEMAND.AND OYERCOME COST AND RISK HURDES

OCR:1|Context The physical challenges of reducing emissions in hard-to-abate sectors are compounded by technological economic and political challenges.

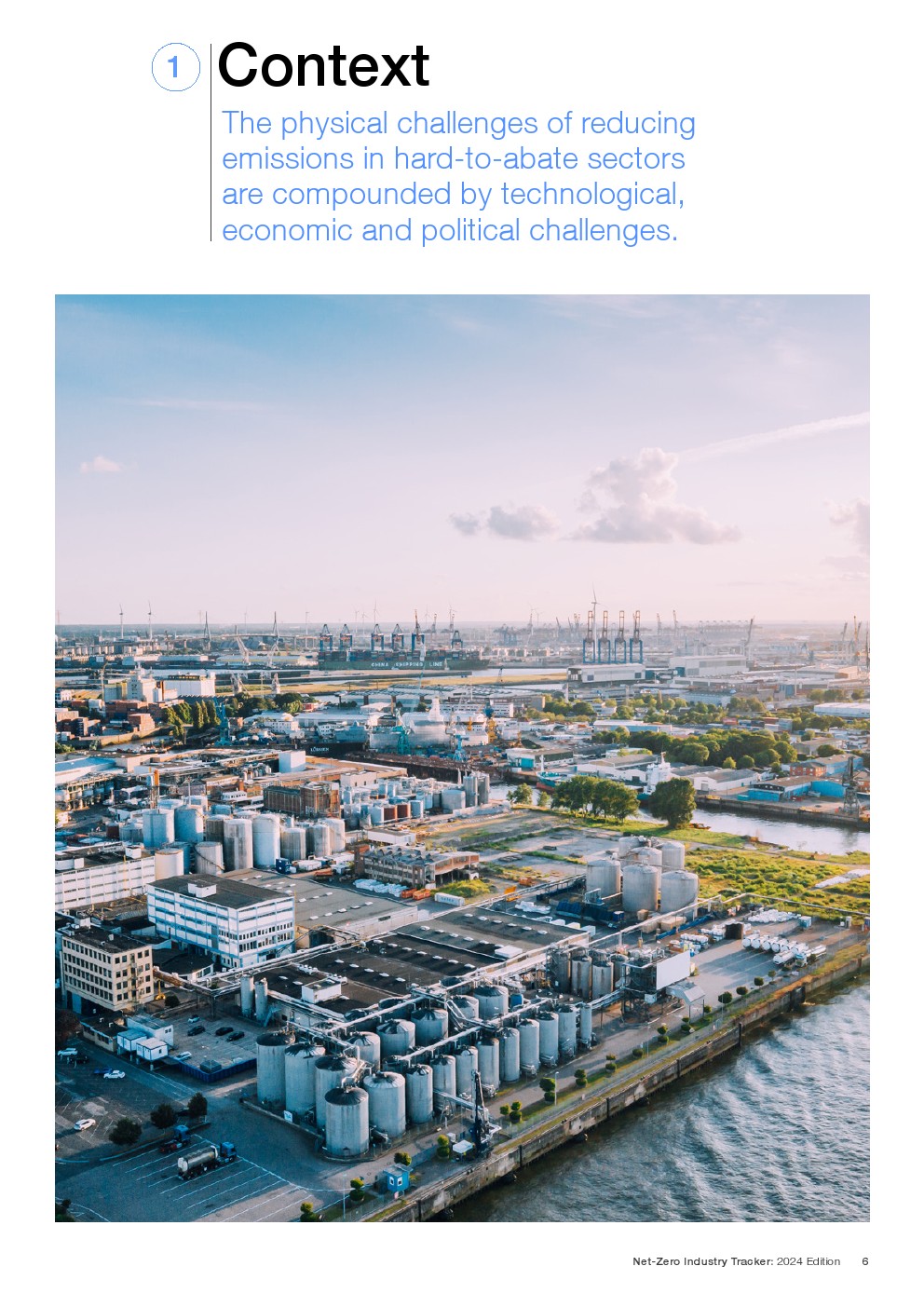

OCR:@While inflation is seeing a decline, interestrates have HARD--ABSETRS EMAIN AMONG remainedelevated DUE TO A 20-40% INCREASE IN despite recent cuts This negatively PROCESSES tHAt Rey on High-TEMPERATURE HEAT OR specialized or energy dense fuel impactstheability ofhard-to-abate GROWTH S UNCERTAIN. TERe HAVE BEEN ENCOURAGING DEVELOPMENTS IN sectors to invest towards reducing DATTERYTECHNOGY.GBA RENEWABLE ENERGY emissions Y2.7MEY TO SCALE BACK THEIR NET ZERO TARGETS deplymentofbatterystoragesystemsithinthe MAKING INTEREST RATES rossa SECTORS TO NVEST TOWARDS REDUCING MISION ORKS AND A CONTINUED DECLINE IN:COSTS MISSO SUCH AS CERTAIN TYPES OF CLEAR SUCH AS THE AVA CD STRAIN ON the maintaining Profitability at tHe exPENSE Of INVESTING

OCR: NCLUDIG THE COVD-19 datastrategysupportedbyditai partnershipsandbecomingmoreself-reliantto platforms'powercanstreamlinecarbon accounting A RISE reporting.Inadditiontotheenancement of SUCH ASA COMPANIES' EMISSIONS REPORTING. THESE INNOVATIONS ANDTH tLwhichcAN MONETARY FUND (IMF). NEW TRADE RESTRICTIONS HAVE GLOBAL TRADE 2038Y COMANEADG10 ACONOMLES OF SCAL THE EIHT HARD-TO AND2GEENUSE GAS are driving transformative changes in businesses glballybyenancingproductiiy PPERATIONS AND REDUCING COSTS. DESPITE PROGRES manycompaniesfacechallengesintheeffeti and FIGURE 1 GLOBAL GHG EMISSIONS (SCOPE 1 AND 2) bY SEcToR Aviation Shipping 3%2% Trucking 5% Steel 7% Cement 6% Thetrackerrepresents 2% Aluminium approximately40%of global GHGemissions 3% Primary Other chemical: 61% 10% Oil and gas

OCR:|Framework The Net Zero Industry Tracker analyses the progress of eight sectors across production energy and transport, in achieving net-zero emissions by2050.

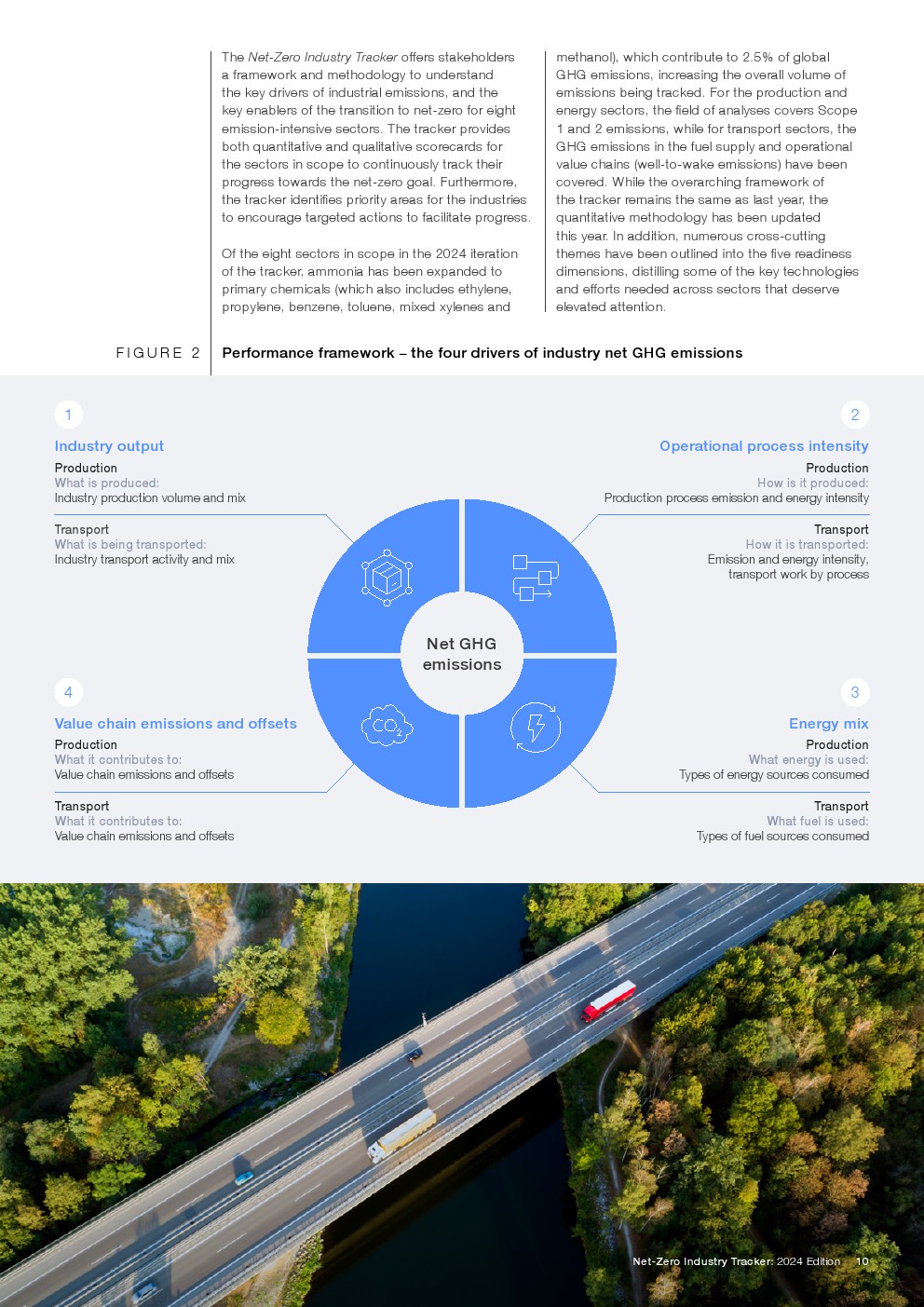

OCR:CHCNTRUTET2.5% OFGLOBAL aframeworkan KEY ENABLERS OF THE TRANSITION TO NET-ZERO FOR EIGHT teffan MISSION-INENSIVE SECTS. THE TRACKER PROVIDES THE both quantitativeandquaitatie GHG EMISSIONS IN THE fuEl SUPPLy AND operationAl THE SECTORS IN SCOPE TO CONTINUOUST TRACK THEIN progresstowardstheneu COVERED. WHILE THE OVERARCHING FRAMEWORK OF AS AST YEAR THE quantitativemet UMU- MMNAEENEXPAND ditilingsome oft eLEVATED ATTENTION FIGURE 2 Performance framework -the four drivers of industry net GHG emissions Industry output Operational process intensity PRODUCtIoN PRODUCTION oduced Industryproductionvolumeandmix Productionproce TRAnsPoR TRANSPORT porte Howitistra EMISS: IntEnsity transportworkbyprocess Net GHG emissions Value chain emissions and offsets Energymix Production PRODUCTION Whatit contributes to Valueaine meo TransPoRt TRANSPORT Wha ntributesto Whatfuelis Value chain emissions and offsets

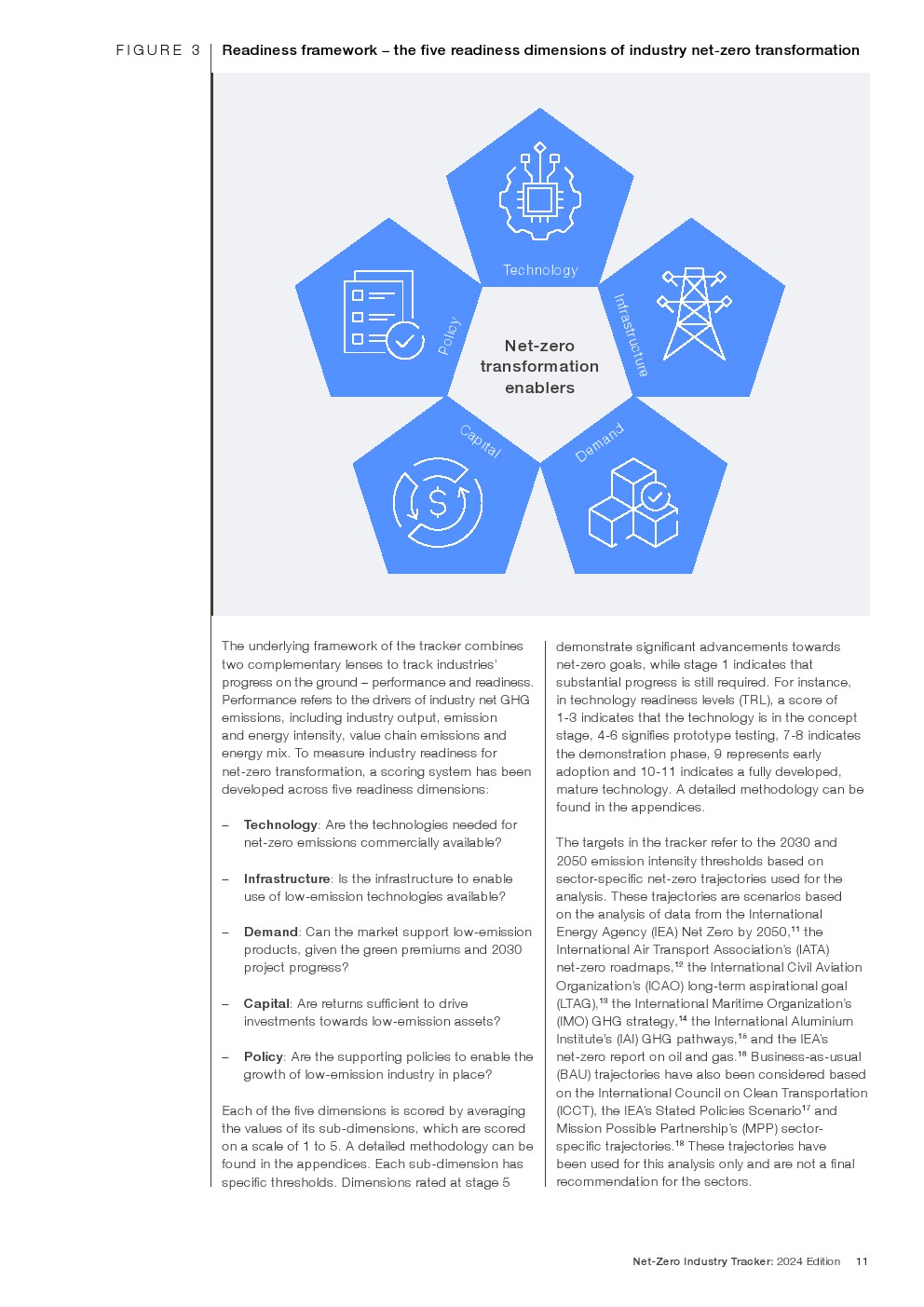

OCR:FIGURE3 Readinessfram ANSTORMATIOL Technology 资 Net-zero transformation enablers THeunderlyigframeworkoftetrackercombin DEmonStrateSignificanT ADANC WHILE STAGE 1INDICATES THAT PROGRESS ON THE GROUND - PERORMANCE AND READINES SUBSTANTIAL PROGRESS IS STIL REGUIRED. FOR INSTANCE ANCEE IN TECHNOLOGY READINESS EVELS (TRL)A SCORE OF EMISSION N 7-8 INDICATES EPRESENTS ARY maturetechgy FOUND IN THE APPENDICES 2050emissinintentyt INFRAsTRUcTuRE: Is the infrastructure To enable SECTOR-SPECIFIC NET-ZERO TRAJECTORIES USED FORTHE SCENARIOS BASEC ontheanalysisofdatafromtheInternational DEMAND:CANTHEMARKET SUPOR 1 TH GIVEN THE GREEN PREMIUMS AND 2030 INTERNATIONAL AIR TRANSPORT ASSOCIATIONS (ATA) PROJECT PROGRESS2 ANZAI( CAPITAL: ARE RETURNS SUFICINT TO DRIVE (LTAG)13 HE INTERNATNAL MARITIME ORGANIZATION'S investments towards bow-emission assets? 1 AND THE EAS growth of oW-Emissin inDustry in PlACE? WICHAR SCORED MISSION POSSIBLE PARTNERSHIP' (MPP) SECTOR- NACAL OF5AMEANE beenusedft SPecific thresHOLDS. DIM ATED AT STAGE 5 lendationfor the sectors

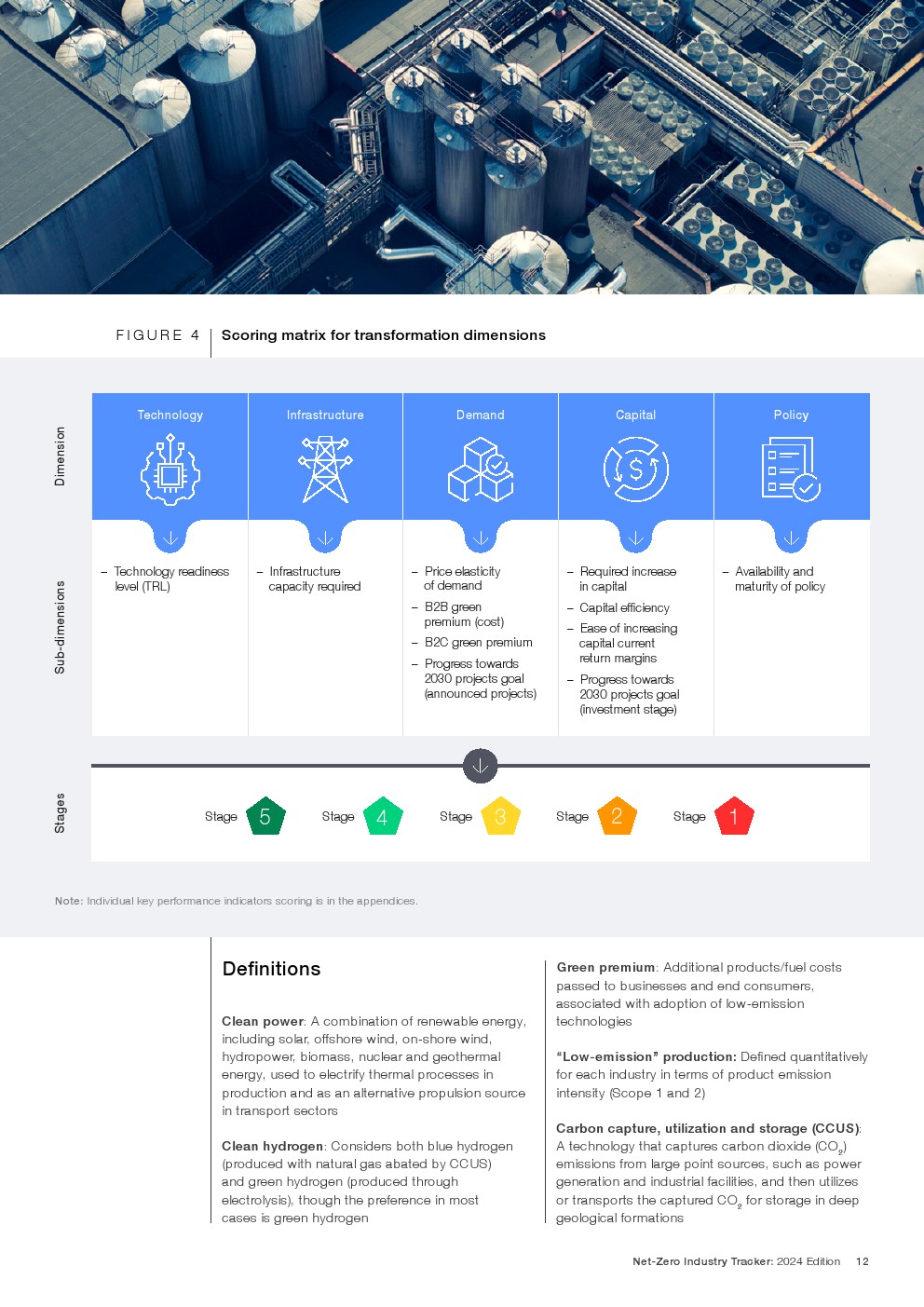

OCR:FIGURE41 Technology Infrastructure Demand Capita olic 爱 PRICE E AVAILABILITY AN AVEL (TRL) CaACiYrequired incapital B2B greer CAPITAL EfficeNcy PREMIUM (COST) EASE OF INCRER SIng - B2C GREEn PrEMIUM -PrOgR ETURN MARGINS (ANNOUNCED PROJECTS) INVE Definitions IUM: ADDITIONAL PRODUCTS/FUEL COSTS SED TO BUSINE: AND END CONSUMERS associatedwithadoptionofw-emission Technologies N “Low-emissionproductionDefinedquantitatively NERGY. USED TO ELECTRIFY THERMAL PROCESSES IN FOR EACH INDUSTRY IN TERMS OF PRODUCT EMISSION INTENSiTY (SCOPE 1 AND 2) in TRAnSPORT SEcToRS Carbon capture SUCH AS POWE andgreen hydogen geneatina LECTROLYSs) THOUH THE PREFERENCE IN MOST FOR STORAGE IN DEEP CASES IS GREEN HYDROGEN Geological formations

OCR:ICross-sector findings The sectors in scope last year have made progress in emissions reduction, but improvement in sector readiness scoreshasbeenJimited

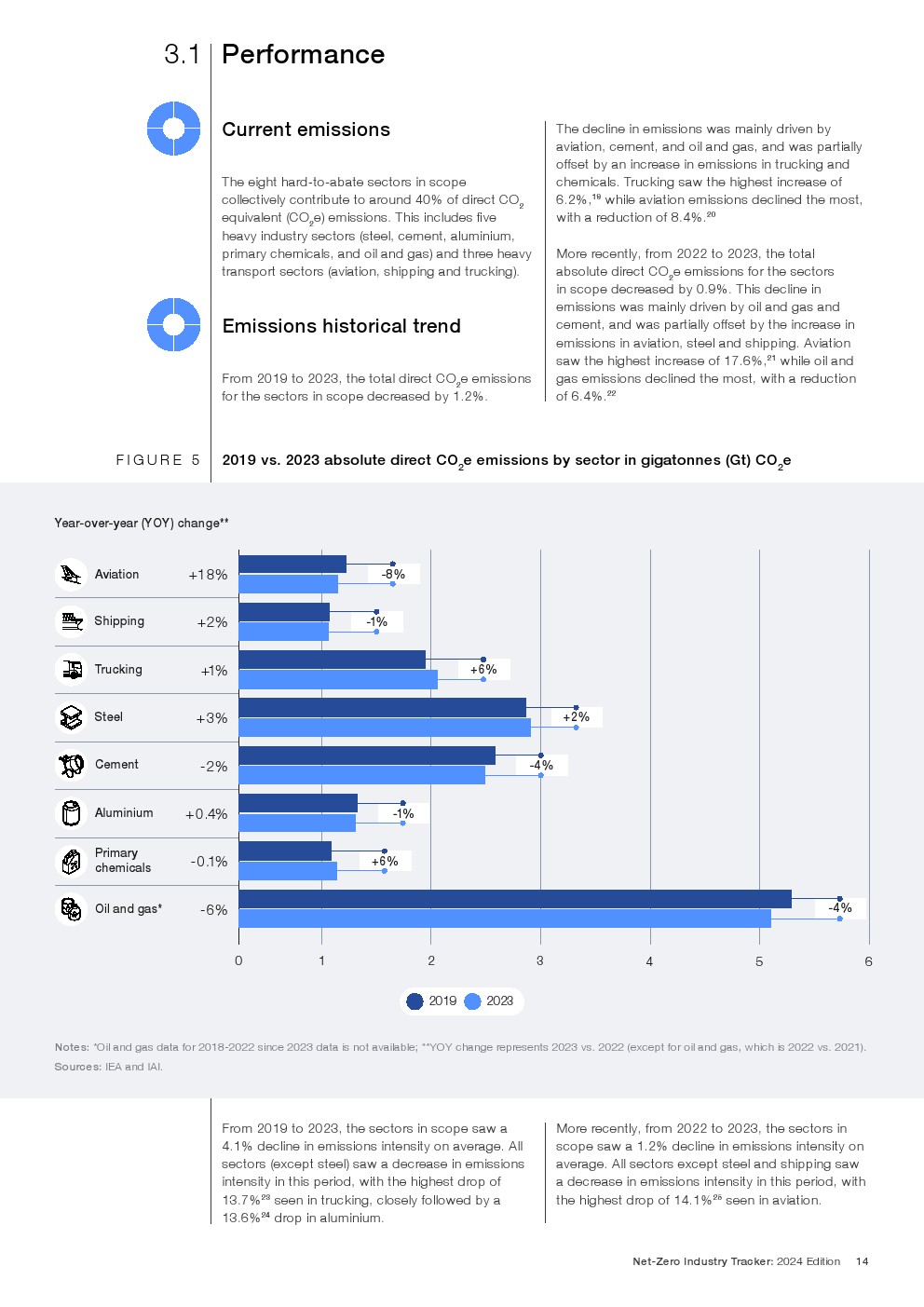

OCR:3.1|Performance Current emissions THE DECLINE mAINLy Driven by THE EGHT HARD-TO-ABATE SECTORS IN SCOPE CHEMICALS. TRUCKING SAW THE HIGHEST INCREASE OF 6.219 While avi WitH A REDUCTION Of 8.4%.20 CMALUMNU THE TOTAL EMISSIONS FOR THE SECTORS IN SCOPE DECREASE D BY 0.9%.THIS DECLINE IN EMiSSIOnS WAS MAINLY Driven by OIL AND GAS AND Emissions historical trend TEANDG AVIATION GAS EMISSIONS DTHEMO TAUTI BASEDBY 1.2% OF6.4%.22 FIGURE 5 2019E eMissiONbY SECTRNIGAONES(GT) COE YEAR-OVER-YEAR (YOY) CHANGE* Aviatior +18% 型z Shipping +2% 淘 Trucking S STEL +3% *9 CEMENT -2% @ AUMINIUM +0.4% -0.1% @ OLAND GAST 6% NOTES:LANDGASDAT Sources:EAandAl SCOPE SAW A 1.2% DECINE IN EMISSIONS INTENSITY ON SECTORS (XCEPT STEEL SAW A DECREASE IN EMISSION: inemissionsintensityinthisperd THE HIGHEST DROP OF 14.1%2 SEEN IN AVIATION 13.6%2 DROP IN ALUMINIUN

OCR:FIGURE 611 2019 VS.2023emissionsintensitybysector R-YEAR(YOY) CHANGE* AVIATIO lgCo,/tRPK -14% 墅 Snoinan P +1% -1% 8 +2% -0.2% -0.2% Aluminiun tCO.M) -2% -2% NA 0 20 Notes:land gas

OCR:Industry output relatEd Policies. The heavy tRANSPORT SECTORS SAW AR ERAGE 6.9% INCREASE MAINLY DRiveN bY THESHARP SS THE EIGHT SECTON NGWHILE AVIATION DEMAND SAW A DECLINE Drienby the eavy NDUT EIH SAW A THE SECTORS IN PRIMARY CHEMICAS AND GXCEPT CEMENT SAW AN INCREASE DURING THIS PEROD aluminium saw the highest growth across the heavy MAINLY EVERNGFROM DUE followe By OiL AnD gAS WITH A 2.9% INCREASE.: FIGURE 7 2019 VS. 2023 DEMAND BY SECTOR T-YEAR (YOY) CHANGE: Aviation +37% TilonRPK Shipping +2% +0.1% 2% +3% C ChanaCaIs +2% OllaNd.GAS +3% 500 1.000 1.500 2.000 2.500 3.000 3.500 4.000 4.500 2019 2023 EA AND IAI

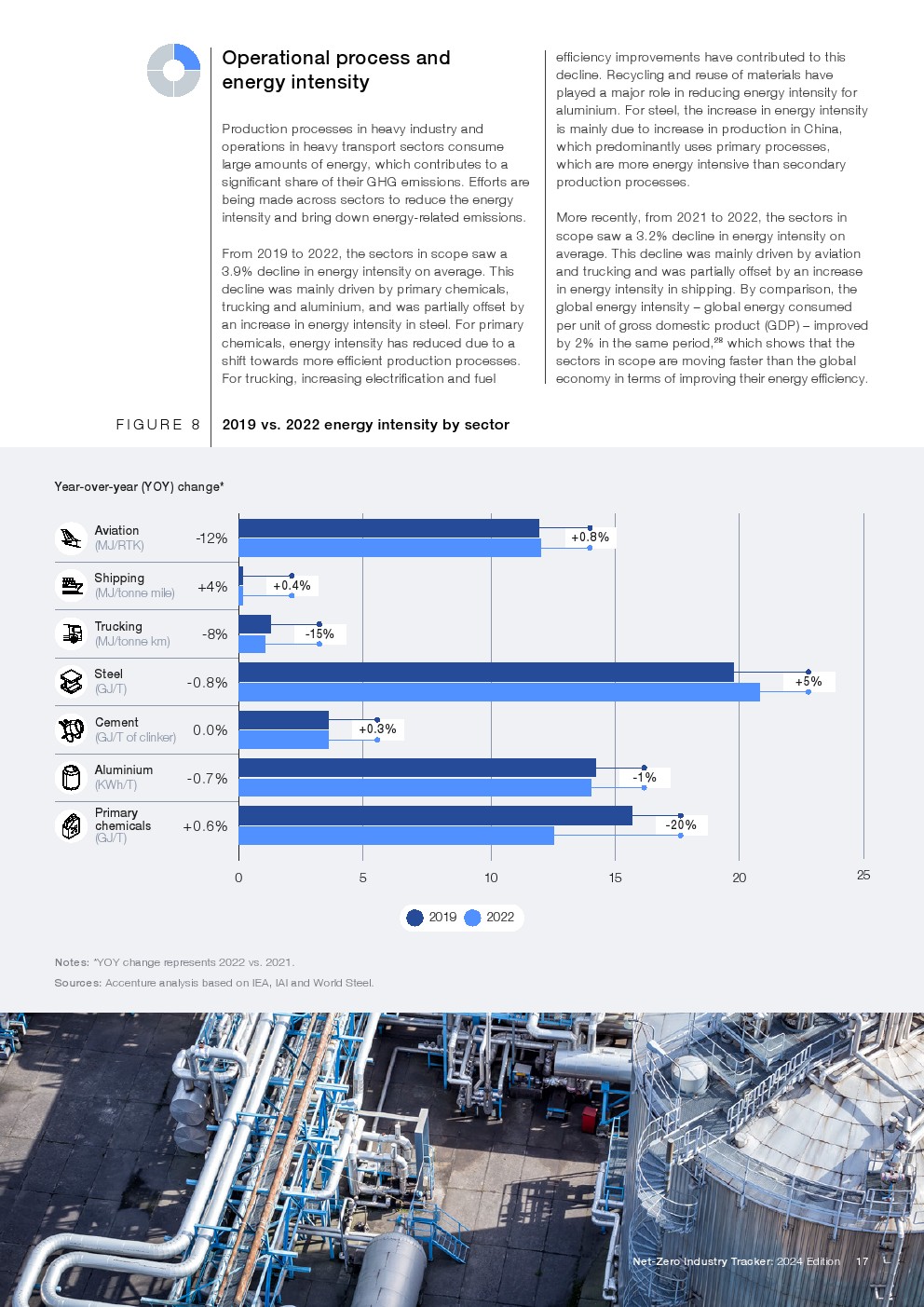

OCR:Operational process and energyintensity ALumium.ForStee THE iNCREASE IN ENERGY INTENSITY PRODUCTION P SSES in HEAVY INDUSTRY AND peratineanectorsconsume Whicharemoreenergintensivethansecondary SIGNifcAnT SHARE OF THEIR GHG EMISSIONS. EFFORTS ARE PRODUCTION PROCESSES intensity THESECTORS IN SCOPeSAWA32 THE SECTORS IN SCOPE SAW A aVERAGE.THis decline WaS MainLy driven by aviation yhpgBy cmrison te ANDwaataly offsetby NGNNASUU by 2%in thesame period28 which shows that the SECTORS IN SCOPE ARE MOVING FASTER THAN THE GLOBAL Ftucgincreasingelectrificationandfu economy interms of improving their energyefficiency FIGURE 8 2019 VS.2022 energyintensitybysecto YEAR (YOY) CHANGE: AVIATION -12% ShIPPING +4% Twucking .8% -0.8% 0.0% (KWh/T) -0.7% Cronanals +0.6% GT 0 202

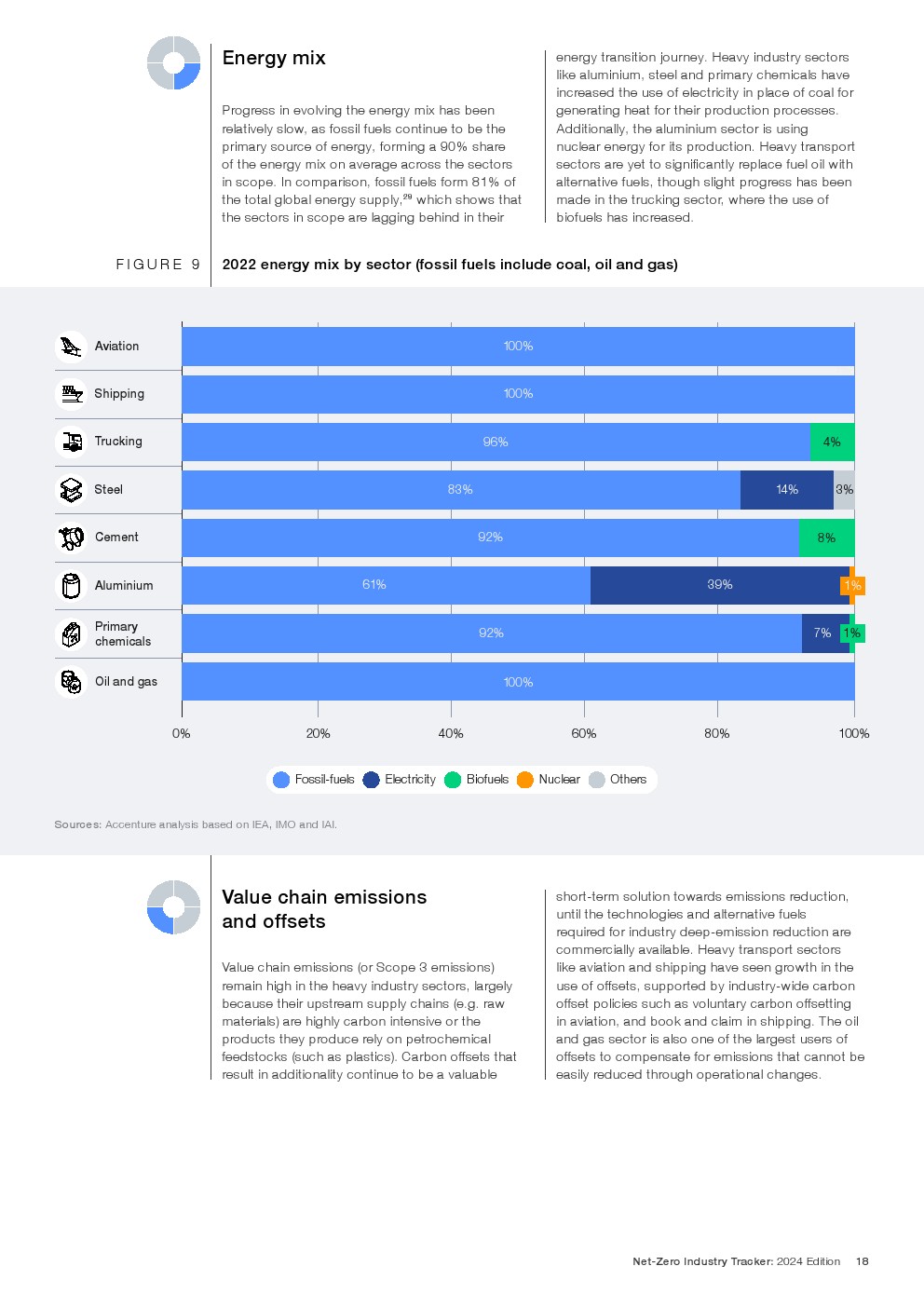

OCR:Energy mix seeada GEERATING HEAT FOR THEIR PRODUCTION PROCESSES THE ALUMINIUM SECTOR IS USING FORMINGA90%SHARE UCeAR NERGY FOR iTS PRODUCTION. HeAVY tRANSPORT ttefit FOSSIL FUELS FORM 81% OF THOUGH SLIGHT PROGRESS HAS BEER biofuels has INCREASED FIGURE 9 Aviation 100% 型z Shipping 100% 淘 Tucking 83% 14% * CEMENT C AUMINT 619 399 92% TOILAND GAS 100% 0% 20% 40% 60% 80% 100% FOSSiL-TUER Othen VaLue chain emissions and offsets untilthete requie COMMERCIALLY AVAILABLE. HEAVY TRANSPORT SECTORS : ORSCOPE 3 EMISSIONS ARGEL DECAUSE THEIR UPSTREAM SUPPLY CHAINS (E.G. RAW OFfSET PoLiESSUCHASOUNTARY CARBON OFSETTING esult inadditionality continue to be a valuable

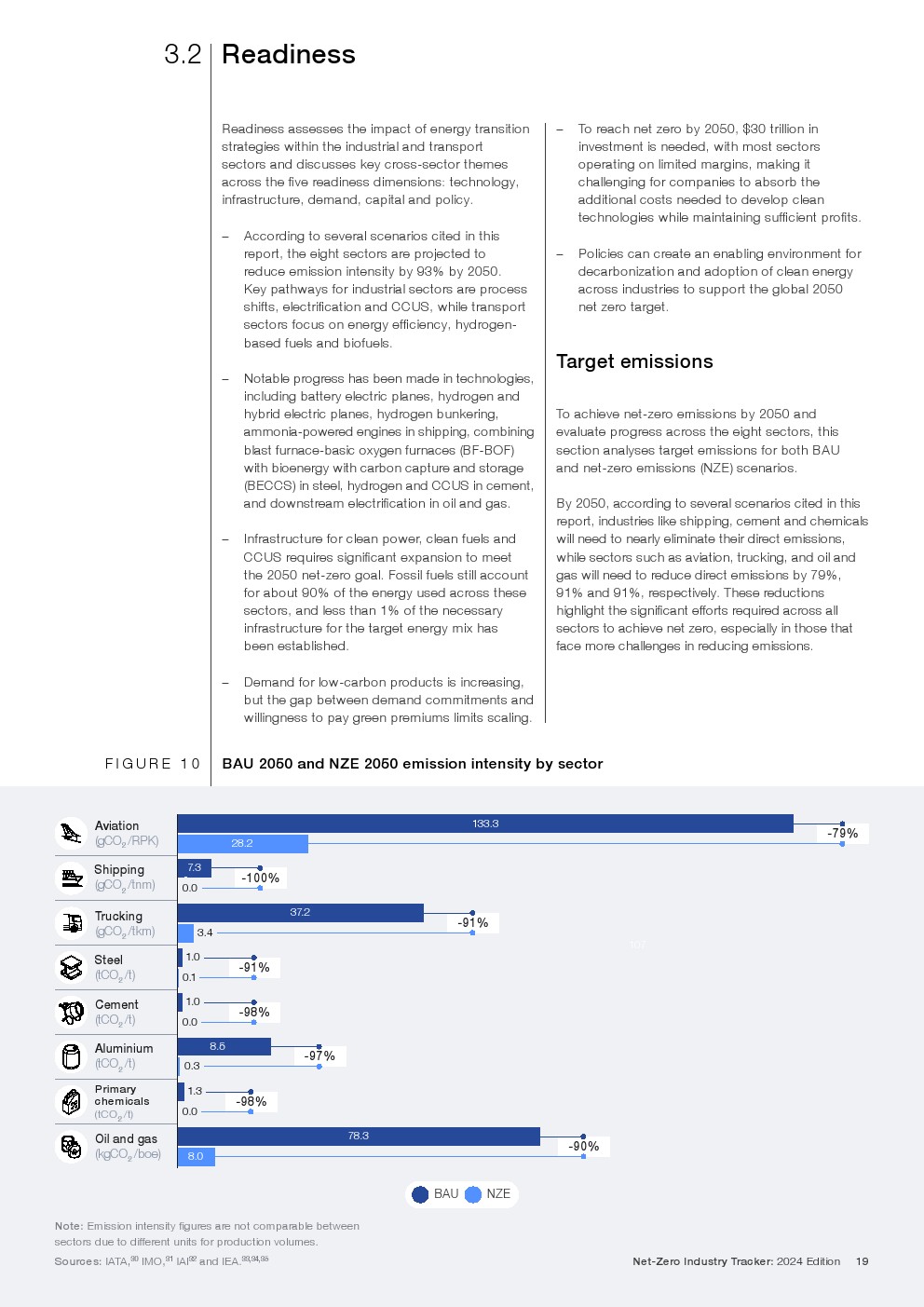

OCR:3.2|Readiness $30 TRILLION IN WIH MOST SECTON SECTORS AND DISCUSSES KEY CROSS-SETOR THEMES PPerating on limited marginsmakingit CHALLENGING FOR COMPANIES TO ABSORB THE Technologies while maintaining sufficient profits ACCORDING TO SEVERAL SCENARIOS CITED IN THIS POLICESCANREATANNANG NVRONMENT OR deaona NET ZERO TARGET DASED FUESAND BifUElS TARGET emissions TO ACHIEVE NET-ZERO EMISSIONS BY 2050 AND aMMONa-powered engines in shipping.combining T Withbioenewtcabonc weclean fuels and C FORABOUT 90% OF THE: THESE REDUTNS highlight the significant efforts required acrossall infrastructure forthetarget energy mix has PEAY IN THOSE THAT been established bUT THE GAP BETWEE EN DEMAND COMMITMENTS ANG FIGURE 10 BAU 2050 anD NZE 2050 emission intensity by sector AXIATIO IgCo/RPK 型 Shipping 7.3 -100% GCO./ OUGES ATA0MO 1 A/

OCR:Decarbonization levers ABSOLUTE DIRECT EMISSIONS FROM INDUSTRIAL SECTORS (STEEL CEMENT ALUMINUN 2030D 2050 lARGELy due to the adoPtion of various techNolgies FIGURE 11 Contribution to emission reduction by decarbonization lever for industrial sectors andtopmitigationmethods Topthreemitigationmethods SINOILANG -41% 99% Electrification DY 24% 93% 2022 2030 2050 OIDED DEMANT Energyefficiency EleCtrification ! :OTHER FUEL SHIfTS Hydrogen OTHER PROCESS SHIFTS : CCCUS DIREcT Emissions WIL NEED TO DECREASE BY AROUND 2050. ACHIEVING THESE REDUCTIONS 8 AND INFRASTRUCTURE

OCR:FIGURE 12 1 Contribution to emission reduction by ded bonization leverfortransportsectorsand topmitigationmethods Topthreemitigationmethods -62% -basedfuels nergye by 21% 88% 2022 2050 :ACTIVITY INCRE Energyefficier Hydrogen-basedfuels DELECTRificATIOr AvOiDed demand : Bifuels CCCUS

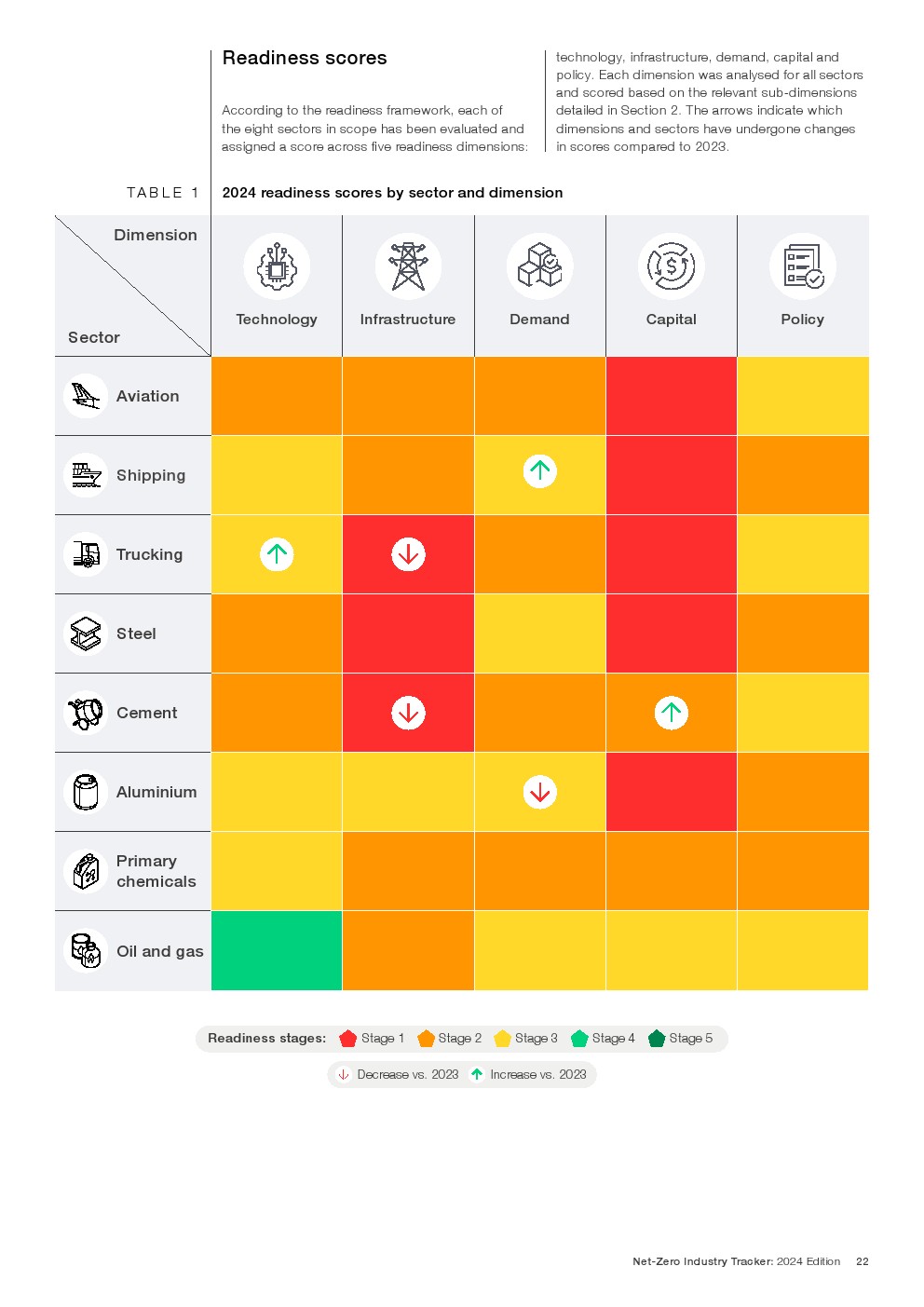

OCR:Readiness scores CATALAND policy.Each dimensionaa ACCORDING TO THE READINE DeE S2.THE AROWS INDCATEWHICH THN PE AS BEEN EVAUATE AND dimensions and sectons have UNDERGONE CHANGES IN SCORES COMPARED TO 2023 TABLE 1 2024readines sectoranddimension Dimension 爱 Technology Infrastruoture Demand CApitAl Policy Sector Aviation Shipping TruckiNg S Steel W CEMENT Aluminium PRiMARY Chemicals OIL AND GAS Readinessstages STAGE: DECREASE VS. 2023 TSE VS. 2023

OCR:Technology Keyreadinessquestion GENERATIVE AL SIGNIfICANTLY ENHANCES de AR THE TECHNOLOGIES N emissions MANAGEMENT AND OPERATIONAL PROCESSES COMMERCIALLYy AvailAbLE? ANDAUTOMATING Keymessages COMPANIES EDU SeveraL TechnoLogies HAVE SEEN AN INCREASE THE GROWING ENERGY IN THEIR TL SCORES COMPARED TO AST YEAR demandsof increasedelectriity consumption and moest e hydrgen bunkering and VMU EFficIEnCY GAINS withBECCSinsteelyd CM AND DOWNSTREAM ELECTRIFICATION IN OILAND GAS. FIGURE 13 emissionstechnologiesacross Sectors (2022-2024) Aviatior Shipping Trucking STEE CEMEnT Aluminium OILAND GAS O2022 ementsin the past year ofelectricity for secondary aluminium smelting TUCKNTHESC NCEASED OM 23 HAVINGATRL METHANOL-POWERED ENGINES eARTY ADOPTION PHASE implementation witha TRL of9 CHALENGES: WhicH ARE EXPECTED TO BECOME AVAILABLE BETWEER THE DEvELOPM DLOYMENT OF NEY SEVERAL TECHNOLOGIES decarbonization technologies often face prolonged timelines

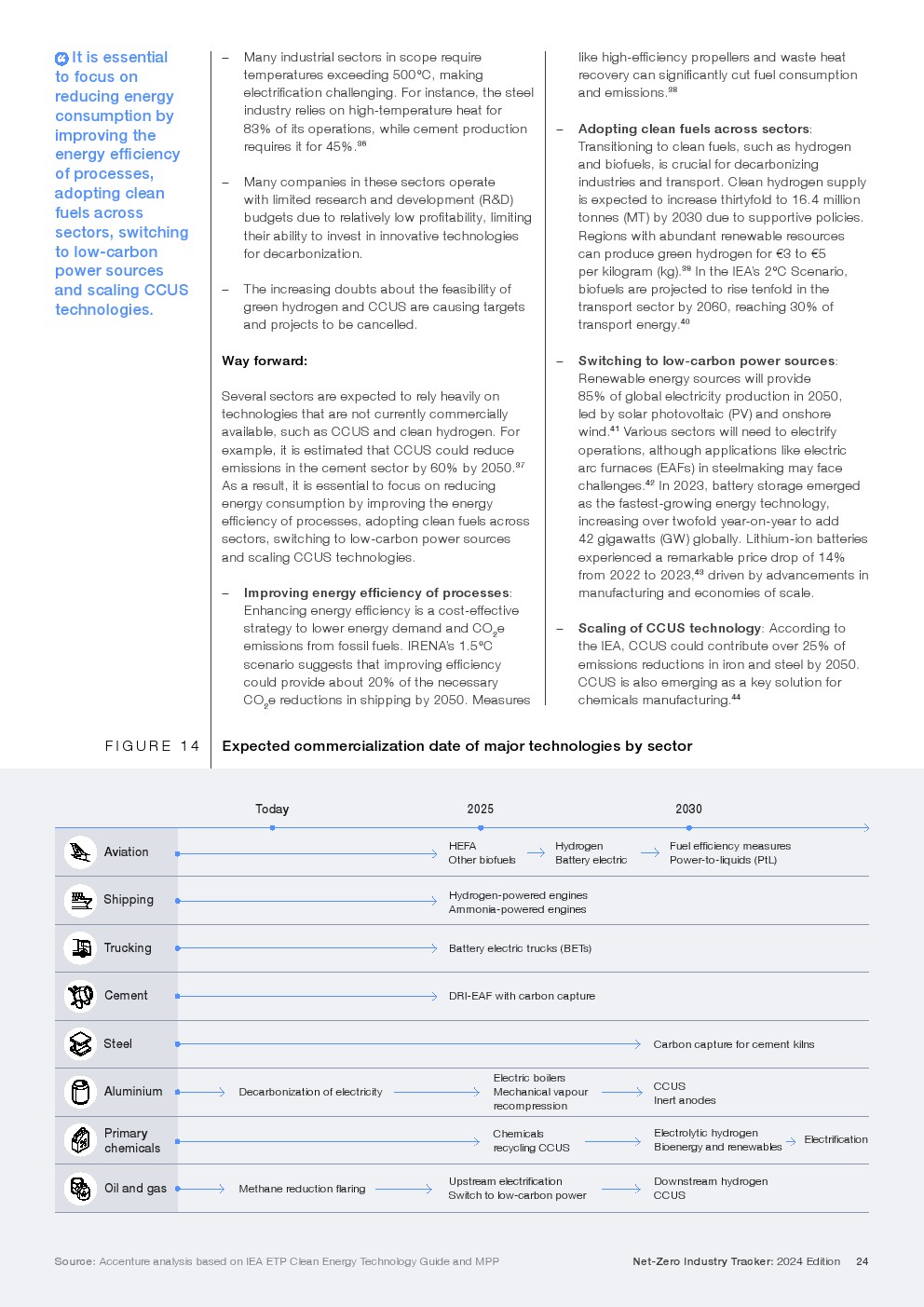

OCR:?ltis essential to focus on MAKING VERY CAN SIGNIICANTLY CUT FUEL CONSUMPTIOR reducing energy THE STEE AND EMISIOnS.8 consumptionby industry Relies on high-temPErAtURE HEAT fOR CEMENT PRDUCTION Adoptingcleanfuels: improvingthe rOSs SEctors energyefficiency REUIRES IT FOR 45%.36 SUCHASHYDRGEN ofprocesses, MANY 0 COMPANIES IN THESE 1 SECTORS OPERATE adoptingclean SEhirtyfolto16.4millior fuelsacross iit sectors, switching Regionswith abundant renewablereSOUrCES to low-carbon For Decarbonization power sources and scaling ccus T technologies. EACHING 80% OF AND PROJECTST TRANSPORT ENERGY.40 WAY FORWARD: Switchingtolow-carbonpower sources SEVERAL SECTORS ARE KPECTED TO RELY HEAVILY OR FO ND4N IT IS ESTIMATED THAT CCUS COU REDUCE icationetr emissions in the cement sector by 60% by 2050.87 arcfurnace( IT IS ESSENTIAL TO FOCUS ON REDUCING WCN WR SUE 42Liti-atte and 4DRIVENBYADVANCEMENTSIN MAnufACTURING AND economies of scale Scaling of ccus technology: According to CUSCU CONTRUT R2 CUS FIGURE 14 Expectedcommercializationdateofmajortechnologiesbysector TODAY 2025 2030 Aviatior HEFA Shipping Hydrogen Trucking DRI-EA STEE Aluminiun DECABONZATIN OFELECTRICITY CCUS CHEMICAR G CCUS OilaND gas CCUS

OCR:?Digital te IEA.46 IENANCES SITE SELTION OR CARON technologies tohelpcompaniesintheir decarbonization efforts storageto offer significant optimizes CCS efficiency by monitoring the advantagestohelp CARBONMANAGEMENTTHEMARA CAPTURE PROCESS companies in their emergedfordataanaiati decarbonization efforts, specifically OperationalefficiencyGenerativeAlenances CABONMANAGEMENTANDnity: ASSET MANAGEMENT AND ERATIONAL PROCESSES. BY inoperational Automating emissions management! efficiency,capital ATRCKA- andcarbon Optimize productionsystems:Al helps ptimizeseeg management REDUCING GHG EMISSIONS THIS AND IOWERING CARBON FOOTPRINTS boostsefficiencywhileminimizingenergyuseand DRECTL SUPPORTING DecaRbOnization Managingcarbon credits:Alautomates the Improveassetenergyefficiency:Alenables COMPLIANCE With emissions regulations while ettemntoring ensuring that Maximizing green premium opportunities HELPING COMPANIES CHOOSE OW allocationandproject managementby emissions acrosstHe SUPPLy CHAIN. Modelling energytransitionscenarios Forecastingenergy and emissions:Al ENABLING INFORMED desnnalati f Alowing COmPANIES TO TAKE PREVENTIVE MEASURE AND CARBON-NEUTRAL PROJECTS with sustainabilitygoals time-to-market and minimizing capital EXPENDITURE (CAPEX) OVERRUNS IMPROVING CCS: AL HAS THE POTENTIAL TO LOWER indicating that their energy COnSUMPTION COULD ACCORDING TO THE

OCR:Infrastructure Key readiness question ANNUM (TPA) OT (GTPA) OF CCUS.4 emission technologies available2 Keymessages CAPACITY IN 2050 IN THEIR NET ZERO EMISINS THE REGUIREMENT FROM THESE 250 NET-ZERO SCENARIO IS 4.8 TERAWATTS (TW) OFCLEAR 55% FOR CCUS.49 FIGURE 15 Aviatior ShIPPING Trucking STEE CEment Aluminium OILAND GAS C2022 202 2024 ementsin thepastyear CLEAN OWER CLEAN IT S APOWERAND CCUS CAPACITY. important to lookat theavailability of infrastructure ANDAS T MEET THE 2050 INFRASTRUCTURE REGUIREMENTS AS THE SECTORS IN SCOPE TRUCKING: THE SCORE DECREA ASED FROM 2 TO : 90% OF THE ENERGY USED ACROSS THESE SECTORS. AND ClEan POWER TO MEET ENERGY REqUIREMENTS OSSIL FUES FORM 81% OfTHE TOTAL AND THE SNCANT CAACITY INCREASE REGUIRED TO 4 COMPARED TO THE OTHER SECTORS IN SCOPE TRANSITION JOUNEY

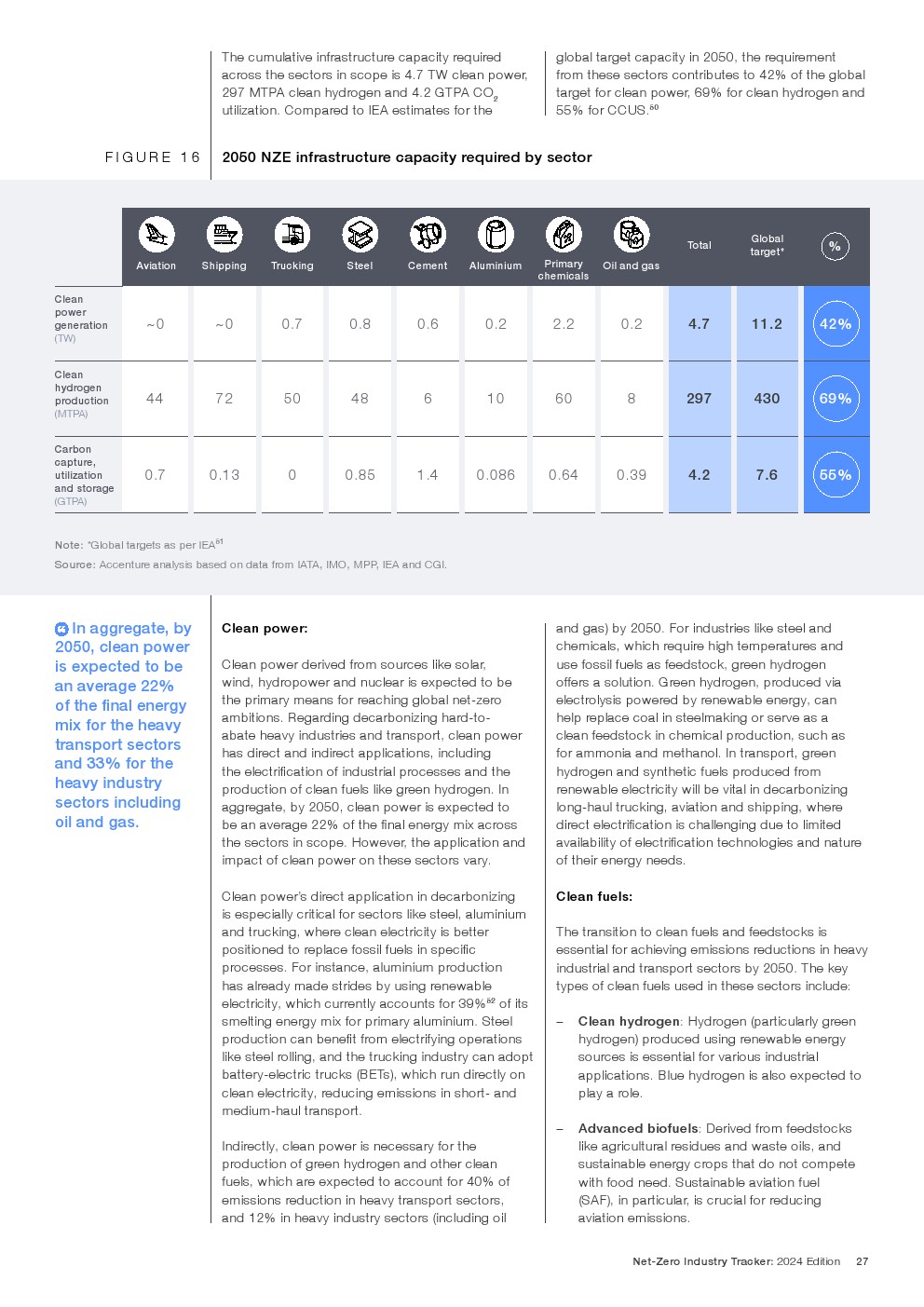

OCR: THE REGUIREMENT romte 69%forclean HydROgenaNd utilizationComparedtoatt 55% FOR CCUS.5 FIGURE 16 2050 NZE infrastructure capacity required by seotor P Tota Aviati Shipping Oiland gas -0 -0 0.7 0.8 0.6 0.2 2.2 0.2 4.7 11.2 42% Clean 44 72 50 48 6 10 60 297 430 69% MTPA 0.7 0.13 0.85 1.4 0.086 0.64 0.39 4.2 7.6 669 O.MPP IFA ADDCG @lnaggregateby CLEAN POWEN ND2FR 2050cleanpower ChemicalsWhiH require higH TEMPERATURES AND is expected to be Ceae anaverage22% YDROPOWER AND NUCLEAR IS EXPECTED TO BE RD of the final energy mixforthe heavy CLEAN POWE SUCHAS transport sectors NLUDNG GREEN and 33%for the heavyindustry produtionofa renewableelectricitywill bevitalindecarbonizing sectors including Where oilandgas. Deanaverage22%ofthefnalenergymiacross THE APPLICATION AN ipactofcleanpoweronthese sectorsvary: OF THEIR ENERGY NEEDS Clean power's direct application in decarbonizing Clean fuels ALUMINIUM AND TRUCKING WHERE CLEAN ELECTRICITY IS BETTER mee CLEAN HYDROGEN: HyDROGENAtArGe play a role NEDium-HAUL TRANSPORT. Adancedbofue INDECTLY CLAN POWER IS NECESSARY FOR THE AND productionofgeeny WTUT40% WS EMISSIONS REDUCTION IN HEAVY TRANSPORT SECTORS. CRUCAL FOR REDUING AND 12% IN HEAVY INDUSTRY SECTORS (NCLUDING OIL AVIATION EMISSIONS

OCR:?Theanalysis -6MISSION FUEL (ZEF SOURCES UCMASANTRIITY) IN THE showsthatan ECTEDT LAYA CRUCIAL average 61%of EN HYDROGEN OR FROM NATURAL able feedstocks like energy needed CANREDUCE in 2050climate IFECYCMISSI Y UPT 80% COMPARED TO MEtCleafuef scenariosfor ENTIONAL JET FUEL THE ANALYSIS SHOWS THAT methanocanbeprducedfrom 400 MTA OFSAAN heavytransport SCef THETRUCKING INDUSTRY EXPLRING sectors (excluding trucking)and21% WAsTE: REnewable MU for heavy industry AND RESIDUE WASTE AREIMPORTAN: will be sourced in someapplications suchasin kinsin tHe electrifiedforcertaintransport cases from cleanfuels CEMENT INDUSTRY CLEAN FUES ARE EGUALLY EEDEMATEARS AND 21% FOR HEAVY INDUSTRY hydgen To eLAC COL IN THE PRODUCTION PROCES: SECTORS WIL BE SOUCED FROM CLEAN FUELS CHEMICALS INDUSTRY RECEIVES 93% OF ITS ENERGY IHTEMPERATURE PROCESS HEAT (TEEL CEMENT) AMMONA AMEAN teate EACEDBY OTHER ENERGY CARIERS (SUCH fuels is being explored to lower the CArbon footprint AND HEE WILL BE STRONG THesetransitinsare COMPETIION for tHOSE CEAN ELECTRONS FOR USES IN T LAN FU develop alongside electrification industries in a low-CARBON ECONOMY ammoniaandmethanoareeentiatmet INTernAtionAL MARTIME ORGANIZATION'S (IMO) TARGET STEE Cei 2050.AMMONIAANDMEtA fft SNfICANTLweRiNgth todecarbonizeuine CARBON FOOTPRINT Of MARITIME TRANSPORT WHEN THEY POWER AND PROCESS CHANGES. TO ADDRESS THIS A MULTI-ACETED APPROACH INVOING CCUS AND

OCR:?ccusis IS witaac expectedto accountfor18% AND 1% of global emissions STANDARDS AND ACCOUNTING ARE ALSO INSUFICIENT TO CCUSATIN AND reductioninthe heavyindustry yiccana lecmparablityan byprovidingalow-carbonfuelalternativeforheavy sectorsand 1%in industry and transport the heavy transport sectorsinscope APRATNA CCUSCAAITY by2050. WITH OVER 110 SAND SAFETY CUS INVESTMENT COUD RISE ALMOS Wayforward BOOSTINGgLbALCO Whilecke DESPIE CRUCIAL FOR DE MUCH GREATER INVESTMENT IS NEEDED TO ACHIEVE et-zer TE CAPACITY R ECOSYSTEM WiTHA NOTABLE PORTION ALLOCATED TO ENERGY d REPRESENTING LESS THAN 10% WRTT far beLW tHE 2 THEY NEED TO CAPTURE BY 2030 UNDER THE aluminiumandtruckigenergymixby2050 TECHNOLOGICA THE RELATIVE ROLE OF TRANSPORTAND STORAGE TenewabLes AND ELECTRifICATION IN THE CEMENT AND Chemicalssectorsismorelimitedia majrbarriers toscaling CCUS in time to meet expected to be only 8%@ of the 2050 power mix for EMISSION REDUCTION TARGETS fromtheUSInfrastructureInvestmentandJobsAct avesignificantly WHICH MUST BeavAilABLE PROMPTLY TO MEET GROWING CCUS DEMAND ENI HAS GASEOUSAND SD CEAN H n Creatin fa CUS SUCH AS EEDSTOCKS SHELLAND TOTAL HAVE INVESTED IN THE NORTHERN Lights Project WITH NEW TRANSPORTAND CHEMICAL ENTERING THE MARKET. THIS INCREASED COMPETITION CHALLENGES: CleanpowerPolicynt mUtPemierDeSPiTethegrowthinCCUS INSUFFICIENT INVESTMENT IN GRID infrastructurepreventing fasterexpansion Of renewabe cumbersome administrative TRANSPARENCY emerging AND developing economies industris can benefit from collaborating with each CMBINED CaPITALiZiNG On EcONOMIeS of scale

OCR:Demand Key readiness question Standarduainty CAN THE MARKET SUPPORT loW-EMissIoN nge IIMITED PREVIOUS EXPERIENCES AND TYPICALLY PROJECT PROgRESS? CARBON PRODUCTS Keymessages Cbetwen sectorsand policy- DEMAND SignAs for loW-CARBON PRODUCTS proveeabilityofae COMMiTMENts anD wilingness to pay green PREMIUMSPCeANTeHNOGY IVSTMEN of low-carbOon Products AT RISK FIGURE 17 DEMAND SCORES FOR LOW PRODUCT: eCtors (2022-2024) Aviatior Shipping Trucking STEE CEment Aluminium OILAND GAS 2022 2023 2024 Sectors with readiness THEpAST YEAR: wiing to invest in clean technologies COM ARED TO AST YEAR AS MPP' ANNOUNCEC Challenges PROJECTS EXC ADED THEGT ALUMINIUM: THE SCORE DED SED FOM 4TO 3 Standarda unifiedindu IOW-CARBON REFINERIES AND SMELTERS BY 2030. FOR IOW-CARBONAND NEAR-ZERO EMISSION PRODAON footprintmethod STANDARDS AVE BEEN DEVELOPED IN MOST SECTORS